Picking up the conversation from Part 1...

Net Working Capital (NWC) is a bit trickier.

NWC is made up of the changes in balance sheet accounts for Accounts Receivable, Inventory, and Accounts Payable/Credit Cards. An increase in an asset account causes a decrease in cash flow while an increase in a liability account causes an increase in cash flow. Let’s take a closer look at that…

Let’s say you have $100,000 in A/R at December 31, 2018 and because you’ve sold more widgets, you have $150,000 in A/R at December 31, 2019. Great! Sales likely went up as did your profit on those sales. However, because you’ve extended more credit to customers who have not yet paid, you’ve collected less cash on those sales.

Now let’s say you had bills out to vendors worth $50,000 on December 31, 2018. Because your business has grown, you now have $100,000 in bills owed to vendors on December 31, 2019. That increase represents cash you have not yet paid to vendors.

Lastly, if you have purchased inventory during the year that you haven’t yet sold, then you have used cash to acquire that inventory, but it is still sitting on your balance sheet. Again, that cash used has not yet gone to your income statement as it has not been sold.

These examples would have the following effect on your cash flow statement:

· A/R change would decrease cash flow by $50,000

· A/P change would increase cash flow by $50,000

· Inventory change would decrease cash flow by $50,000

So, if profit were $100,000 for the year, the net working capital changes above would equate to $50,000 in operating cash flow. [$100,000 profit + $50,000 increase in A/P - $50,000 increase in A/R - $50,000 increase in inventory.]

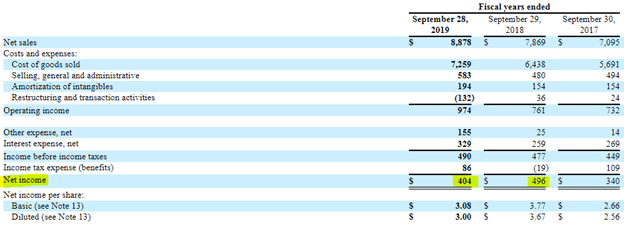

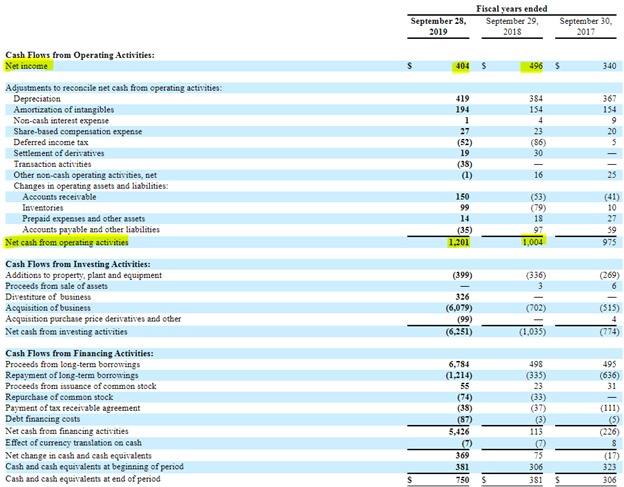

Here’s an example from a set of publicly traded GAAP financial statements:

We can see this business has generated ~$400-500m in net income over the past 2 years…

…But this is just the starting point when looking at cash generated.

Depreciation is a non-cash expense. You buy a piece of equipment for $100 that has a useful life of 10 years = $10 in depreciation expense each year, but the entire $100 in cash went out the door in year one!

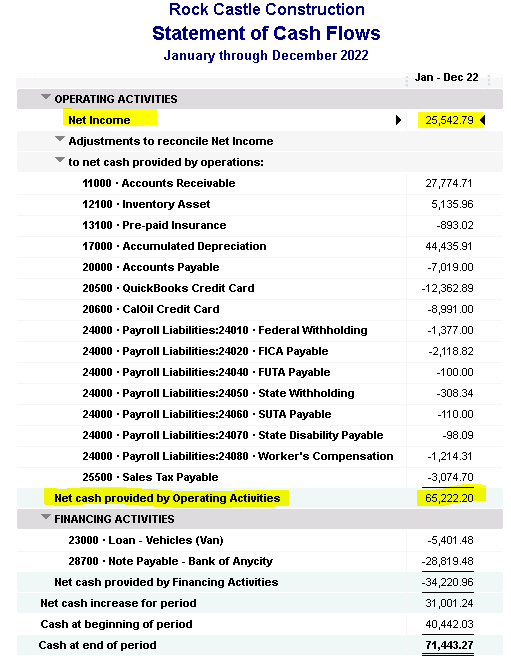

Fortunately, if you are using QuickBooks, that software can calculate a cash flow statement for you under Reports --> Company & Financials --> Statement of Cash Flows.

An added tip: if you need to change the categorization between operating, investing, and financing cash flows, you can do so under: Preferences à Reports & Graphs à Classify Cash.

There are many more intricacies to profits vs. cash flow,but this is a basic outline to help you keep a closer tab on your cash situation (which you should be doing on a regular basis).

If you need help in understanding the implications of profit versus cash flow, our experienced ProAdvisors are happy to lend a hand. Contact us today for a free consultation at info@AlphaAcct.com or (888) 402-2203.